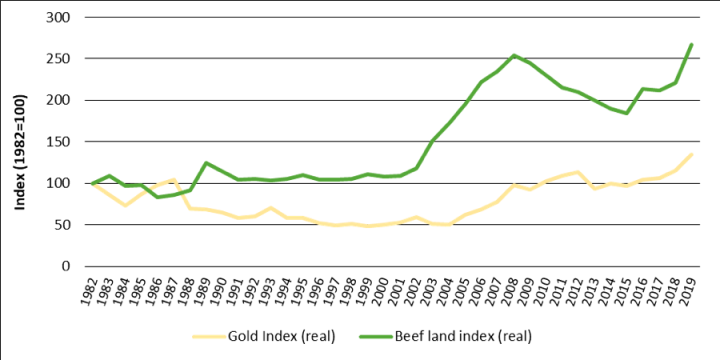

Budgeting beef prices difficult in current market

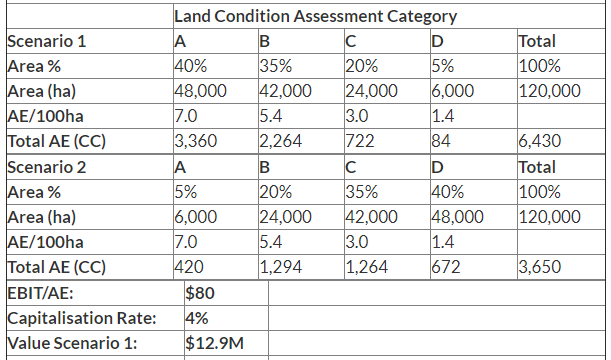

The stars are aligned for the beef industry at the moment, with beef prices are at or near the 100th percentile of long-term prices and interest rates at historical lows. If the forecasted La Nina eventuates, then we will have the trifecta! Our analysis has found that, for average producers, the majority of long-term profits are made in those periods when the stars are aligned. Top performers also do well during these years, but are less reliant on these years for their long-term performance. A challenge in periods of fluctuating prices, such as we have seen recently, is determining what prices to use in forward budgeting. We could optimistically say that the current prices are the ‘new normal’ and here to stay, as may have been assumed in the late 80’s,…