The stars are aligned for the beef industry at the moment, with beef prices are at or near the 100th percentile of long-term prices and interest rates at historical lows. If the forecasted La Nina eventuates, then we will have the trifecta!

Our analysis has found that, for average producers, the majority of long-term profits are made in those periods when the stars are aligned. Top performers also do well during these years, but are less reliant on these years for their long-term performance.

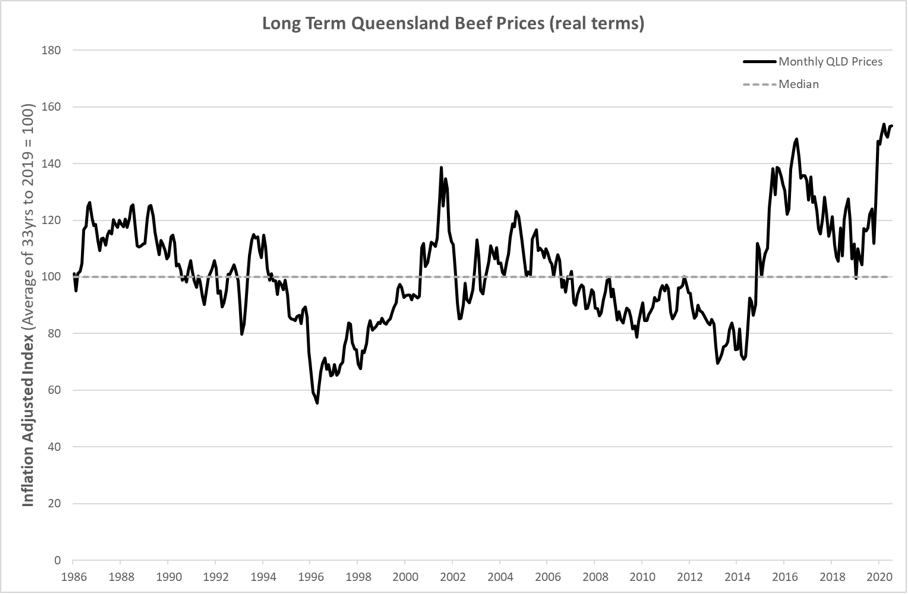

A challenge in periods of fluctuating prices, such as we have seen recently, is determining what prices to use in forward budgeting. We could optimistically say that the current prices are the ‘new normal’ and here to stay, as may have been assumed in the late 80’s, 01 and 16, but this would be overoptimistic.

The above graph is an index of Queensland Beef Prices from 1986 to now expressed in real terms (i.e. with the effect of inflation removed), the southern market follows a similar pattern. This shows that while current prices are at record highs in real terms for the timeframe analysed, prices are very cyclical over time.

Table 1 Decile Table of Qld beef prices (all $/kg LW in 2020 dollars)

Looking forward, the reality is we don’t have a crystal ball and no one can say for certain what beef prices will be next year or in three years’ time. It would be a defendable assumption though, that the cyclical nature (in real terms) of prices will continue; reversion to the mean is a powerful phenomenon.

Historical analyses of prices can be very useful in the budgeting process through using decile tables, which are common in other agricultural industries, but less so in beef. As an example, included is a decile table for Queensland based on 20 years of pricing data to 2020, the median price for yearling steers is $2.49, meaning the price has been this level or less 50% of the time (conversely it has been higher 50% of the time). Note that these are based average monthly prices, so will not reflect the highs and lows of individual lots.

| Deciles | Yearling Steer | Yearling Heifer | Steers & Bullocks | Grown Females |

| 100% | $4.01 | $3.56 | $3.64 | $2.77 |

| 90% | $3.21 | $3.01 | $3.03 | $2.41 |

| 80% | $2.88 | $2.70 | $2.80 | $2.17 |

| 70% | $2.75 | $2.54 | $2.63 | $2.05 |

| 60% | $2.62 | $2.43 | $2.53 | $1.95 |

| 50% | $2.49 | $2.33 | $2.40 | $1.87 |

| 40% | $2.36 | $2.26 | $2.23 | $1.76 |

| 30% | $2.26 | $2.15 | $2.15 | $1.69 |

| 20% | $2.15 | $2.05 | $2.06 | $1.61 |

| 10% | $2.03 | $1.90 | $1.96 | $1.55 |

| 0% | $1.73 | $1.55 | $1.69 | $1.21 |

The application for budgeting is that, rather than having to estimate the prices two and three years out by class and sale lot, an estimate of the price decile produces an estimate of price by class (for example, if we assume the market will be at the 90th percentile of long-term prices next year, we would budget $3.21 for steers). The absence of a crystal ball means that an estimate is still required, but this approach means that only one estimate is required each year, and it can be informed by where the market is in the current cycle. It also allows sensitivities to be easily performed. Asking, what happens to our bottom line if the market is at the 80th percentile next year, rather than the 90th, is easier than trying to adjust the sale price of every sale lot in your budget.

A price budgeting tool with decile tables for all classes of cattle covering all Australian producers is available to all purchasers of the Australian Beef Report. There are separate decile tables and budgeting tools for the Queensland market, the South-East Australian market, the southern WA market and the live export market. These tables and tools will be updated annually for purchasers of the report to download.

The twelve years of production and financial data, for each beef producing region in Australia, as well as analysis by market, herd size and industry (north & south), make the Australian Beef Report a useful resource for both budgeting, and understanding beef business performance generally.

For more information visit www.bushagri.com.au/beefreport.