By Ian Mclean (a summary of his presentation to the Young Beef Producers Forum 2016)

This article was first published on Beef Central

It is an exciting time to be in the beef industry with high prices, increasing demand for our quality product and a positive climatic outlook. But what exactly does this mean going forward for beef producers? What should producers do to capitalise on the current situation, and best position their business for future performance?

A discussion on future performance should start with an understanding of current and past performance of beef producers in Australia. The best available data on long term national industry performance is the ABARES (Australian Bureau of Agricultural and Resource Economics and Sciences) farm survey data.

Analysis of this data shows that the total returns achieved by specialist beef producers in Australia over the last 38 years averages 5.8% p.a. which at first glance appears to be reasonable. However, further analysis is needed as the there are two components to this return;

- the returns from operating the agricultural business (operating return) and,

- the capital gains from owning the land (capital return).

If we split the 5.8% up into these two components, just 0.3% is from the operating return and 5.5% is from capital return. Capital return is important, and is responsible for a lot of the wealth creation in the beef industry, however it has two major drawbacks;

- it is only realised if the land is sold and, therefore,

- it doesn’t pay any bills or provide a monetary return to owners in the meantime.

Operating return is therefore arguably the more important of the two, as it is largely within the control of managers and generates cashflow for the business. The operating return of 0.3% is therefore grossly inadequate, particularly given that it is based on profit before interest, there are insufficient returns to pay interest, grow the business, repay debt or provision for succession and retirement.

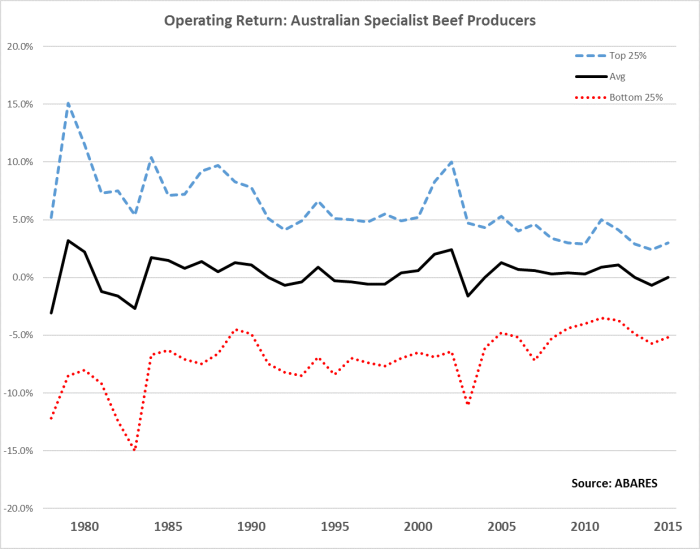

If we look further into this 0.3% average though, there is a wide variation in performance across the industry, the top 25% producers have an operating return of 6.1% and the bottom 25% negative 7.1%. The performance of these three groups over the last 38 years is shown in the below graph.

It can be seen here that there is a wide variation in industry performance. The long-term performance of specialist beef producers in Australia can be summed up by stating

- Some producers are prospering

- Some producers are failing

- The majority of producers are surviving

However, given the large increase we have seen in beef prices recently, will the above continue to apply going forward, or will the significant increase in prices mean the whole industry will prosper?

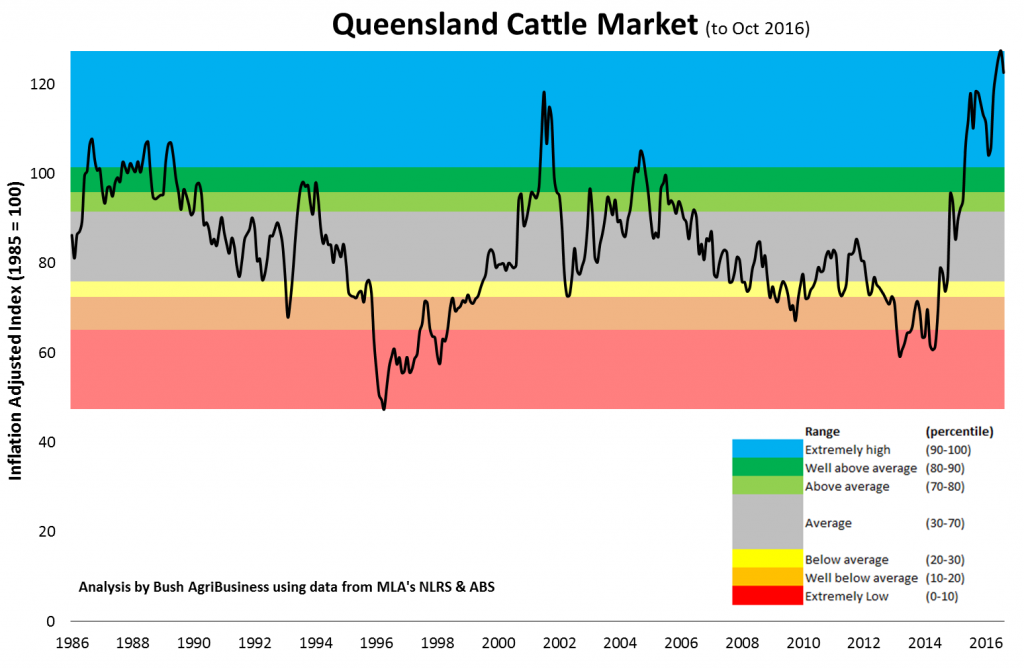

To answer this, the current prices should be looked at in a long-term context and with inflation removed, which the below graph does.

Two key things can be seen in this graph;

- firstly, whilst the current prices are at a record high in real terms (over the timeframe analysed), they are not much higher than the previous highs of 2001

- there is a distinct cyclical pattern in the prices, and we are currently at the top of the cycle

The purpose here is not to be a killjoy or wet blanket with regard to the current situation, the high prices are fantastic for those in production. The purpose is to highlight that average industry returns are historically low, and the recent price increase is not, in my opinion, a panacea that will reverse that.

The question for beef producers is which group do you want to be in in the future? Those that are prospering, failing or surviving?

If you want to have a business that can grow, provision for succession and retirement, repay debt and provide for all the needs of the family, and not be reliant on land value increases to increase your wealth, then you simply cannot afford to be an average producer.

How then do you ensure that you are an above average producer and do more than survive? A detailed understanding of the following will be a good start;

- the factors which separate the top performers from the average,

- what determines the profits of a beef business,

- what determines the profitability of a beef business,

- Whether debt is a friend or foe of a beef businesses

- Leasing as an option to increase scale and enter the industry

- The importance of good record keeping